Will converters be buying presses in 2024?

2024 may hold a pivotal turning point for the North American label industry, writes Jennifer Dochstader of LPC, Inc. In this guest piece, Dochstader explores a recent survey exploring capital equipment projections for 2024.

In the fourth quarter of 2023 LPC, Inc set out to determine the current state of the North American label industry and the forces having an impact on flexo and digital press installation rates. For many companies, 2023 was a challenging year in our industry.

By the second quarter, many label converters were reporting a decrease in sales revenues year-over-year. As our corner of the printed packaging market witnessed unprecedented surges in demand due to pandemic forces in the years prior, 2023 painted a markedly different picture for both label converters, and their consumables and equipment suppliers.

In an effort to gauge how this landscape is impacting capital equipment purchasing decisions at the converter level, LPC carried out an extensive research initiative sponsored by four of the industry’s most prominent press suppliers: Gallus, HP, Mark Andy and Xeikon. Our goal was to have in-depth feedback from label converters of all sizes, and companies that serve every end-use segment.

We wanted our sampling to be extensive, and 102 converters participated in our research. We surveyed and spoke to converters with annual revenues of less than USD 5 million who are true generalists and sell to a wide range of segments like food, chemicals, logistics, retail and personal care. We spoke to converters with annual revenues of more than USD 35 million who are specialists, serving only one or two major segments like beverage or pharmaceuticals. We also spoke to the largest companies in our market - multinational converting conglomerates that have been acquiring small to mid-sized converting companies at a furious pace over the past decade.

The list that follows indicates some key collective data points from our total participant group.

Some key data points for participating label converters:

- Participant companies have more than 700 flexo presses on their production floors and more than 160 digital presses.

- Seventeen percent of participants have not yet purchased a digital press.

- The average number of flexo jobs produced per eight-hour shift is 3.9.

- The average number of digital jobs produced per eight-hour shift is 10.3.

- The average annual sales generated per flexo press is 1.9 million USD.

- The average annual sales generated per digital press is 1.6 million USD.

Our goal was a simple one, to capture in real-time what converters’ most significant pain points are and where they see their greatest opportunities for growth and better positioning their companies in an increasingly competitive landscape.

At the heart of our research were flexo and digital presses. After all, the growth of press installations equals the need for more products and services for the rest of the label-production process: labelstocks, anilox rolls, plates, inks, adhesives, varnishes, laminates, dies, press auxiliary equipment, inspection systems, MIS software, and on and on. Printing presses are the cogs in the wheels of just about every other consumable, piece of equipment, and software package on a label-converting production floor and we wanted to explore this foundational element of our industry’s existence and evolution more deeply than has ever been done before.

Converters’ volume growth in 2023

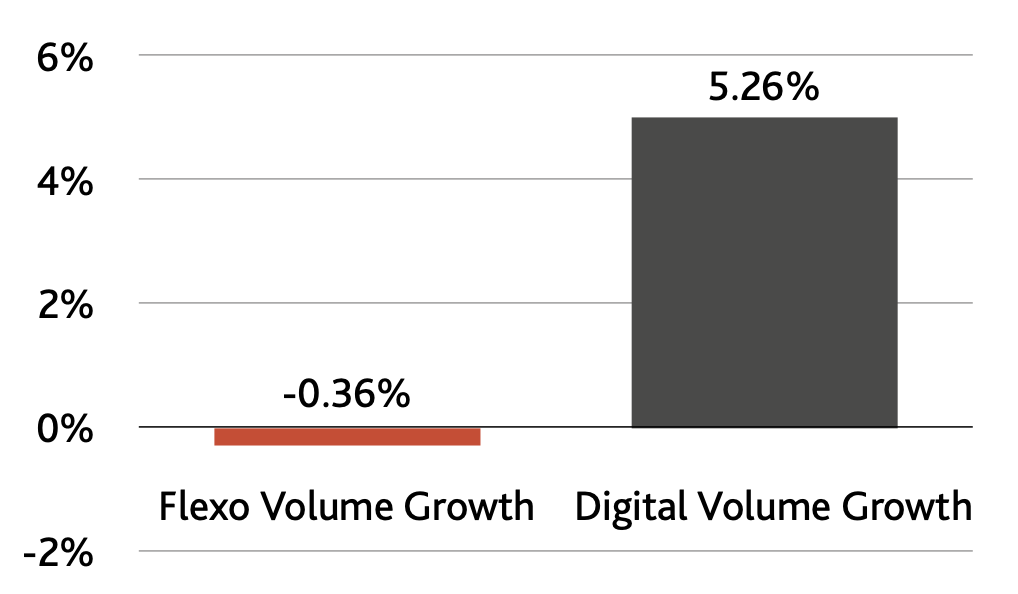

Just how challenging was 2023 for label converters in North America? Some of the first questions we asked participants to answer was to indicate their flexo and digital production volume growth in 2023 compared to the previous year.

Flexo volumes in 2023 declined an average of -0.36 percent (calculated by averaging all responses from the total participant group). If you compare volume growth by company size, small to mid-sized converters fared much better than larger companies. Among converters with annual sales under USD 35 million, 37 percent reported a decline in flexo volumes. In stark contrast, a significant 78 percent of converters with annual sales exceeding USD 35 million reported flexo growth

decline

2023 production volume growth by format: Averages for total participant group

Why such a marked difference between the two groups? The answer lies in the destocking that continued to take place through much of 2023. Larger converters serve larger brands and rising interest rates meant higher costs of carrying inventory at the brand level, leading to significant destocking in addition to the reduction of orders for longer-run applications.

While brands were selling off stockpiled inventory left over from the pandemic, new packaging demand declined due to other economic conditions and increasing levels of consumer caution at the retail shelf.

This created a perfect storm that had a significant impact on our industry’s largest converting companies.

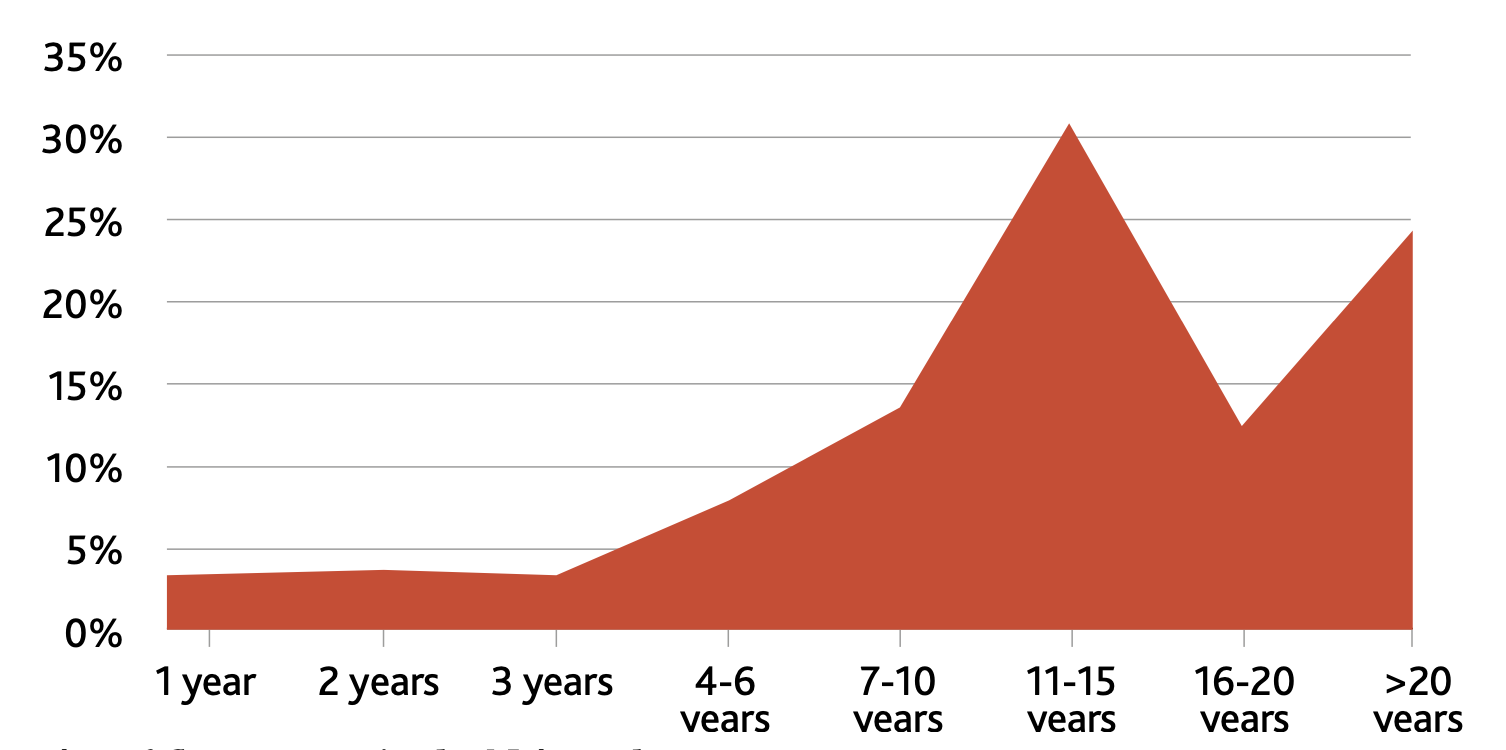

Age of flexo presses

A core part of our overall research strategy was to also determine the age spans of flexo and digital presses in the industry. This is particularly important for flexo presses since there are still a high number of older machines in the North American market. But how high actually is that number? And what happens when these machines age out of the market? Is the tendency of a converter to replace an older machine with a new flexo asset or do they instead purchase a digital press?

To answer the first question, we asked every company that participated in the research to tell us the total number of flexo presses they have on their production floor(s) and the precise age of each one of those presses. We then triangulated

this new data with existing data we have, resulting in the following breakdown of flexo press ages in the North American market.

There is still a lot of older machinery in the market with nearly 25 percent of North America’s total install base of flexo presses being more than 20 years old. Nearly one-third of installed flexo presses are between 11 to 15 years old. We expect a significant number of flexo presses to age out of the market over the next half decade and a key question is how converters will replace this capacity.

Age of flexo presses in the NA market

In interviews, a number of companies referenced the ‘one-for-two’ replacement method - these converters will be retiring two older flexo presses and replacing this capacity with one new wider flexo press. Additionally, due to digital press systems continuously getting faster, and in some cases, wider, digital press adoption rates will in turn also drive converter preferences for wider flexo systems.

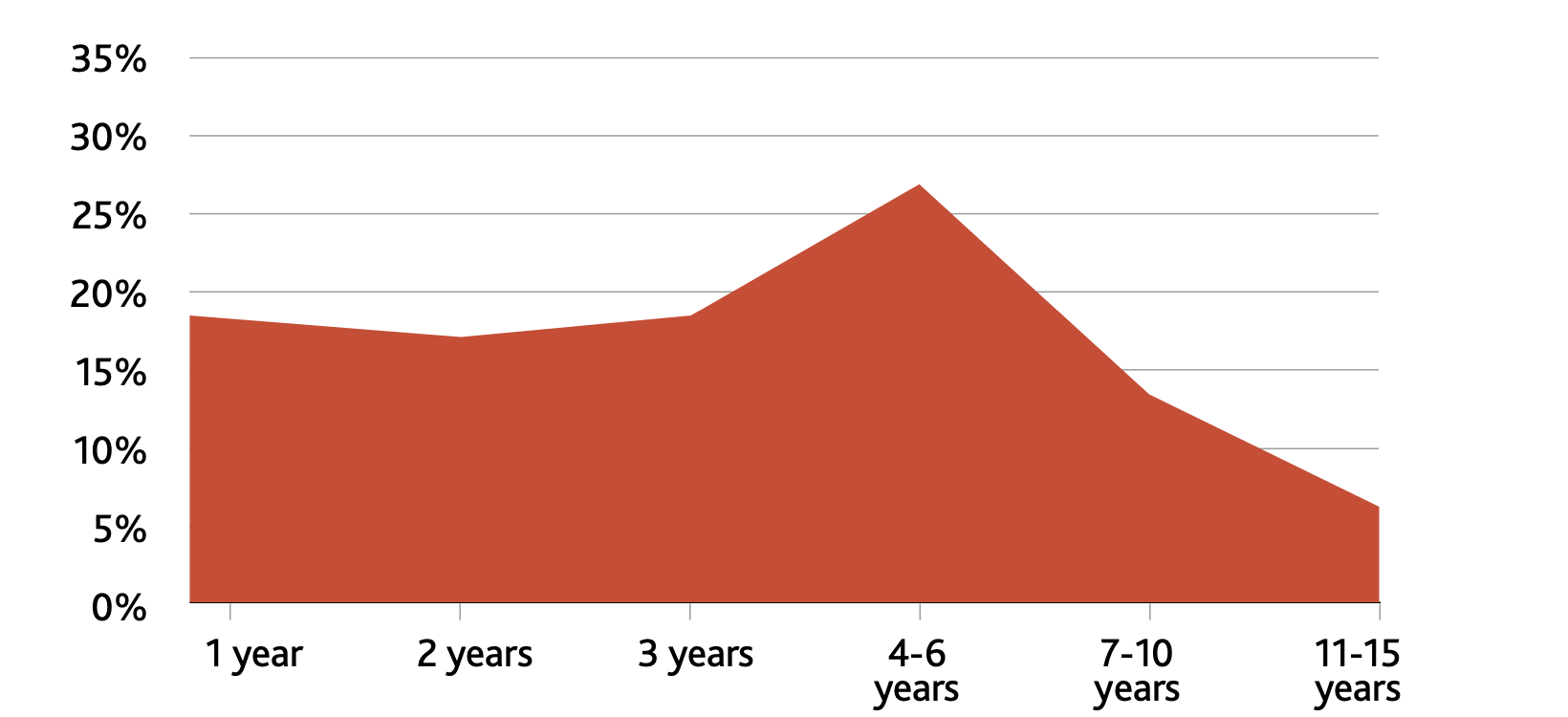

We asked our participant group to also indicate the number of digital presses they have on their production floors and the age of each of those presses. Like with the flexo data, this enables us to break down North American digital press installations by press age.

More than 25 percent of the digital press installation base in the region is made up of presses that are four to six years old. This bodes well for digital press suppliers as companies will be looking to replace these systems in the coming years as the technology continues to change quickly.

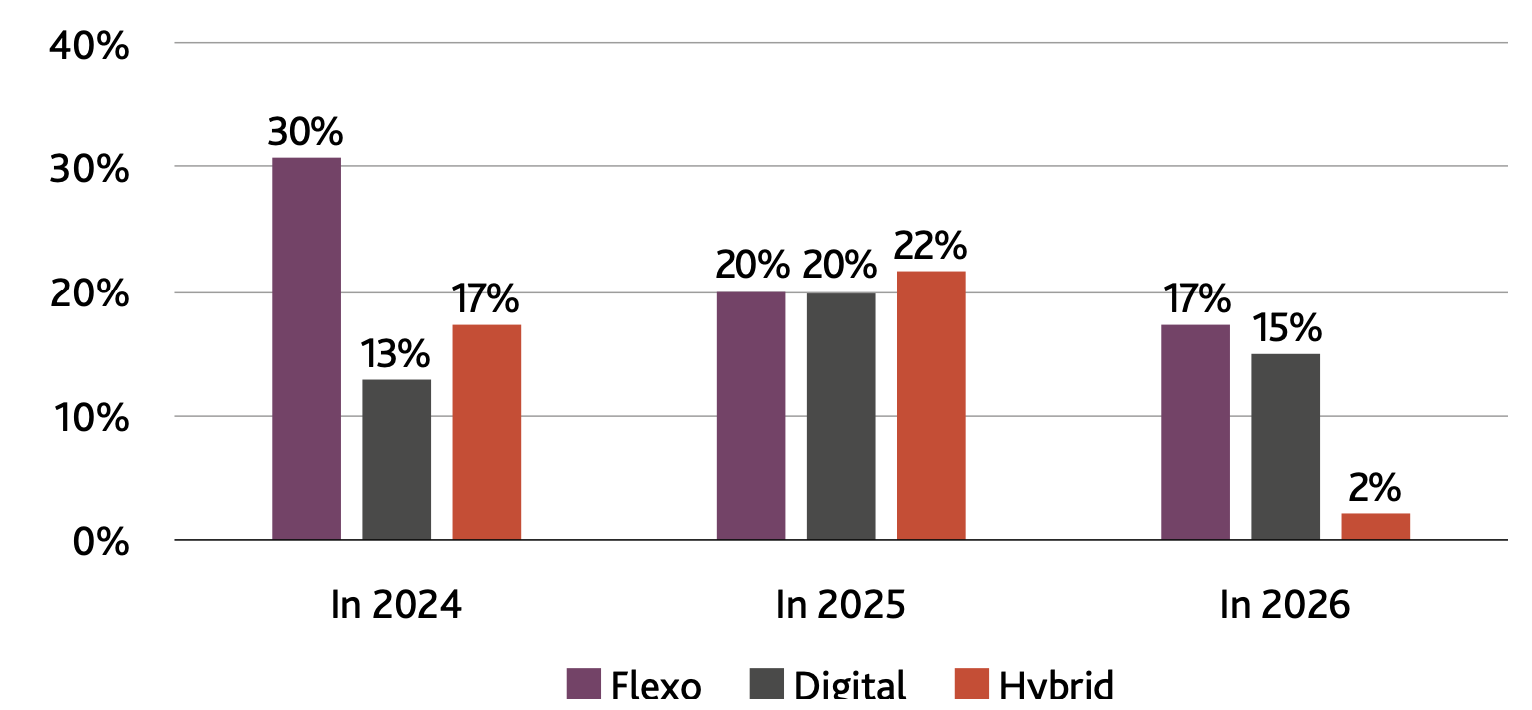

Converters’ press acquisition predictions

Another question that was central to our converter survey was asking companies exactly when they plan to purchase their next flexo, digital and/or hybrid press.

In order to prevent any confusion with nomenclature, in the survey hybrid press was defined as a press that has a digital engine of four or more colors, in addition to three or more conventional flexo print stations along with conventional finishing/die-cutting.

Age of digital presses in the NA market

Nearly one-third of the participant group indicated that they would likely be purchasing a flexo press this year, one of the highest response rates we have ever received for flexo press projections. A number of our participants have already placed their orders for flexo presses in recent months. A central driver that will push flexo press acquisitions this year is a result of decisions that companies made early in 2023. Many of the converters we spoke to indicated that when disappointing sales numbers started coming in at the end of the last quarter a year ago, they decided to push all major planned CapEx purchases to 2024.

However, another critical flexo press purchasing driver was mentioned when we were interviewing companies. Every company we spoke to stressed how dire the situation currently is in trying to find flexo press operators. This workforce challenge isn’t anything new, we have been hearing about the difficulty of finding press operators for the past decade or more. However, during our calls with converters companies indicated that due to the near impossibility of trying to find flexo press operators for second and third shifts, they are having to purchase new flexo presses to add to daytime shift capacity levels. In other words, many of these converters have enough flexo capacity if their presses could be running during these less desirable shifts; they just can’t find the operators willing to work those shifts and run those presses.

Converters’ press purchases 2024-2026

As we peer into the future of the North American label industry, it’s evident that 2024 may hold a pivotal turning point. Converters’ journeys in 2023, marked by fluctuating sales, their customers’ re-evaluation of inventory levels, and the evolving demand for the next generation of printing presses designed to meet the challenges of a post-pandemic world, underscores a landscape ripe for transformation.

Converters are at a crossroads, balancing between advancing technology and the critical challenge of finding flexo press operators. This unique confluence of factors – ranging from the strategic aging out of older flexo presses to the pressing need for wider, more efficient machines – highlights a critical industry shift. Faced with the daunting task of filling the void left by a scarcity of willing operators for off-peak hours, companies are poised to make significant capital investments in new presses, primarily to bolster daytime production. This isn’t merely a response to a temporary predicament but a strategic pivot towards future-proofing operations against the backdrop of a competitive and rapidly evolving market. As converters navigate these turbulent waters, their decisions in 2024 will not only redefine their operational capabilities but also set a new course for the North American label industry.

-

4th Floor,No.428 Wenzhou Avenue,Puzhou Street,Longwan,Wenzhou,China,

-

+86-577-66688057

+86-18058846873 -

Copyright © 2019 CHINA . Wenzhou Andy Printing Machine Factory and Suppliers.